Hello everyone,

Roku is an American company that manufactures digital media players for video streaming. Roku also does lots of advertising and also licesenses its hardware and software to other companies.

Roku is one of leading companies that has a market share of more than 6% worldwide in the smart TV streaming device market.

In the US market of OTT streaming devices, Roku is dominant over all the competitiors by weighing more than 2x to 4x in market share.

It is quite clear that position of Roku has been steady. Their market share has been in range between 33%-38%. However, due to the increase in market share of Fire TV, their #1 leading position is threatened.

Lets take a look at their new shareholders letter.

From Q3 2022 Roku Shareholders letter

As it is mentioned on the letter, there are key results that you have to look at.

- Net revenue grew 12% YOY, to 761 mil

- Platform revenue grew 15%, to 670 mil

- However, gross profit is down 2%

- Number of users added by 2.3mil

- Streaming hours increased, increase of 1.1 billion hours in Q3

- Average Revenue Per User grew to $44.25, up 10% YOY

- Streaming hours on the Roku Channel grew more than 90% YOY

Also, Roku is providing with new smart home products such as cameras, video doorbells, plugs and lighting under the subscription. Home products include cloud recordings of the video, along with AI-based alerts. Also, Roku is selling all their products exclusively at Walmart, in nearly 3,500 locations.

Also the success in launching 'House of the Dragon Exclusive Fan Experience' on Roku attracted many new users. Moreover, Roku has further expanded their offers with leading third-party subscription services like Paramount+.

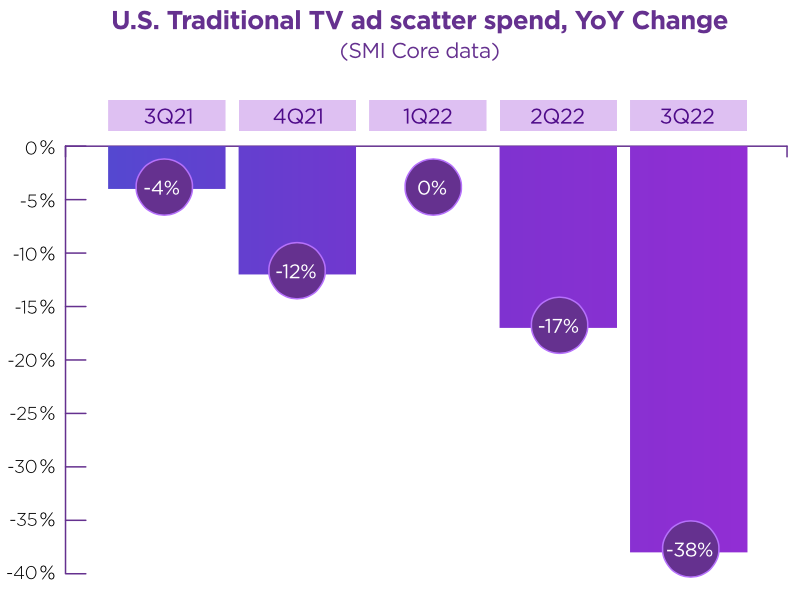

Despite the fact in decreasing U.S traditional TV audiences, Roku managed to increase their revenue by 15%. Also, Roku is planning on spending more on advertising.

Roku plans to stay strong focusing on their vision on long-term opportunity in TV streaming by continuing to innovate and launch new products and parterships with third parties.

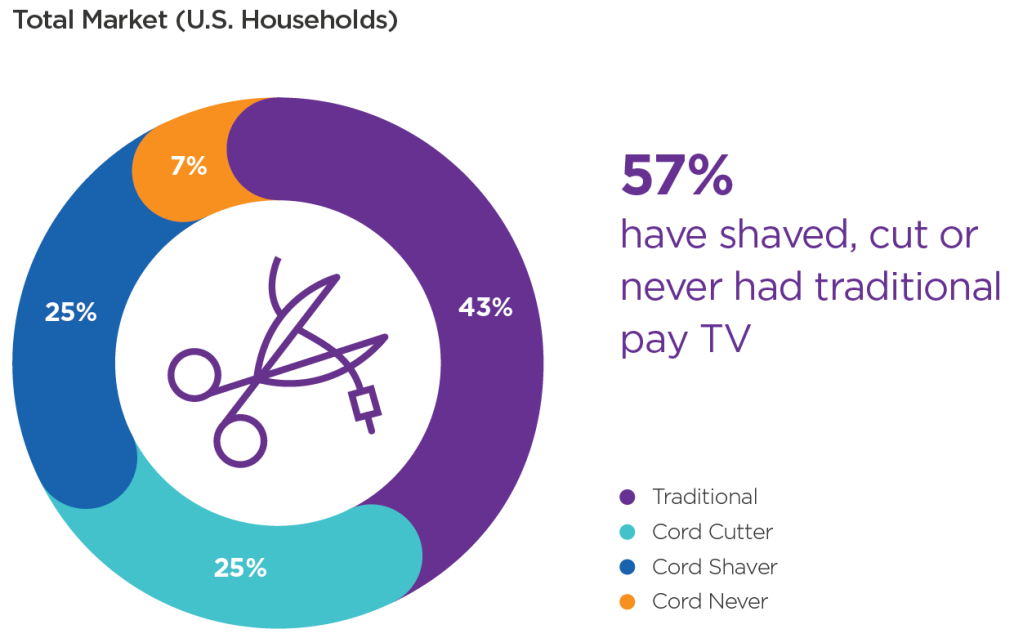

Have you heard of cord-cutting?

Cord shainvg and cutting are when people degrade thier subscriptions on TV or stop using traditional TV or cable. Approximately 1 in 3 TV households do not have traditional payTV and their #1 reason was reducing home entertainment expenses. Around 40% of Cord Cutter decieded their mind because of free TV or free trials to a streaming channel.

Also, accorinng to Roku Annual cord cutting study, 92% of users were satisfied after canceling traditional pay TV and only 17% of recent cord cutter hoseholds would re-subscribe to traditional pay TV.

It seems like as more people become either cord-cutter or curd-shaver, it favours for Roku.

However, can Roku manage to maintain its leading postion in TV streaming being chased after Apple, Google and Amazon?

What will be their next target of revenue? TV streaming, Advertising, Smart Home service, hardware, then what?

We just took a brief look at Roku

Would you include Roku in your portfolio?

Thank you!

.

.

.

.

.

.

Sources:

Roku/Annual cord cutting study

Roku Q3 22 Shareholders letter

Statista.com

CNBC.How Roku used the Netlifx playbook to beat bigger players and rule streaming video

Comscore.Roku Leads OTT Streaming Devices in Household Market Share

Wikipedia.Roku

'주식,Stock' 카테고리의 다른 글

| Shopify #4-1 (0) | 2023.02.02 |

|---|---|

| Waste Management #3 (0) | 2023.01.10 |

| Spotify #1 (0) | 2023.01.09 |

| My Portfolio (2) | 2023.01.09 |

| New Start ! 시작! (2) | 2023.01.09 |